One in 4 middle-income new homeowners — twice as many as a decade before — are buying into cost-burdened situations.

The share of middle-class Americans who are buying wallet-squeezing homes has more than doubled in the previous 10 years.

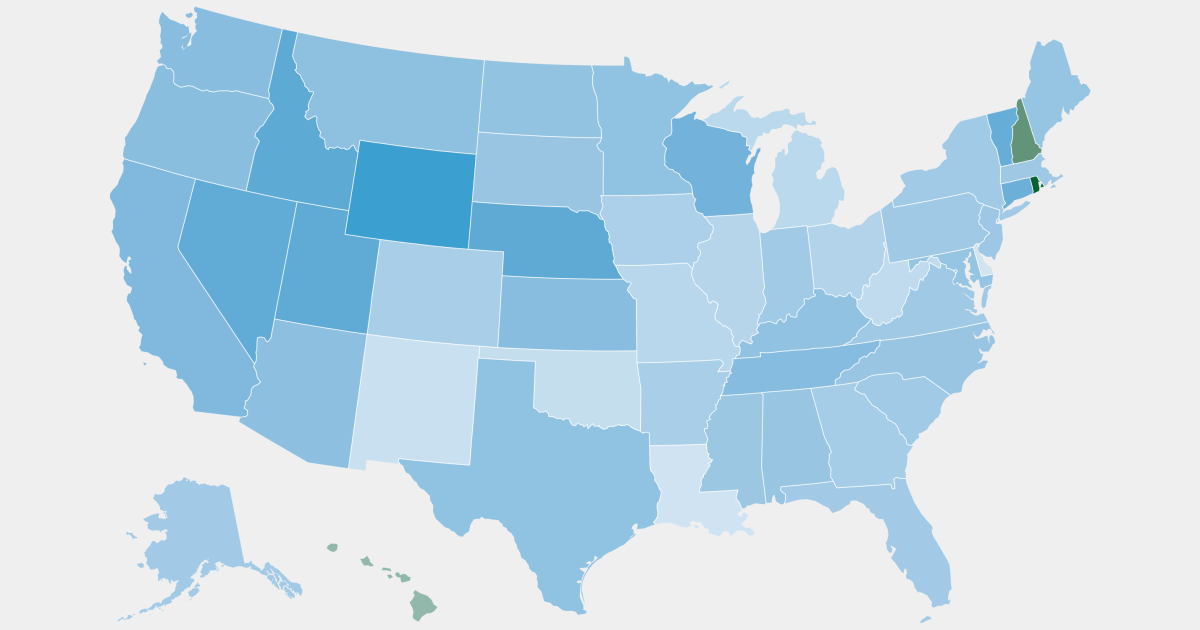

Almost 30% of middle-class homeowners bought homes with monthly payments costing more than 30% of their income in 2022, an NBC News analysis of Census Bureau data found. That’s more than twice the share from 2013, with experts warning it leaves many households with less money for groceries and emergencies and less able to get ahead in the future.

That “cost-burdened” benchmark — in which a household devotes over 30% of income to housing costs — is a widely used measure of affordability for both homeownership and renting. The Census Bureau measures housing costs against it, and the Department of Housing and Urban Development has used it for decades.

It can be, especially if you have steady tenants.

I know ex landlords of mine that barely had to pay out anything over the course of years, while they made 5 figures/year.

Even as a home owner, you can have a string of luck. I have relatives with 20 year old water heaters going strong.

My HVAC is 25 years old and going strong. Only quirks it has is the airflow sensor needs to be blown (haha) once in the winter. Only maintenance outside of the usual I’ve done is replace the fan capacitor.

My water heater is about 10 years old but one of the perks of my gas utility is a water heater warranty so when it comes time to replace or repair part of the cost will be covered.