Summary

The U.S. dollar surged 1.5% and Bitcoin hit a record high after Donald Trump’s projected election victory, as markets anticipate pro-business policies, tax cuts, and inflationary pressures.

Global stocks also rose, with Japan’s Nikkei up 2.6% and Australia’s ASX 200 up 0.8%. Trump’s plans to make the U.S. a “cryptocurrency capital” and potentially increase trade tariffs, especially on China, are fueling market reactions.

Investors are now awaiting the U.S. Federal Reserve’s interest rate decision and China’s economic strategy announcement, as uncertainty looms over global trade and inflation.

Dollar goes up on admin already admitting their plans will cause a recession.

God damn this world is setup huh?

Because investors like 1500% tariffs?

They’re betting that they can sell before that happens and someone else is left holding the bag: pension funds and 401k.

Yeah, time to cash out before the free fall starts.

Unpopular opinion : the crash was going to happen regardless of who’s in charge. The market is long long over due for a major correction.

A correction and a crash are two different things.

This will be a crash. Virtually every economist has said so.

It should have been a correction had it been allowed to happen when it should have.

Now it will be an extreme correction (also known as a crash).

“Both sides both sides”

Hey, bud, your opinion is trash and you can shut the hell up literally any time. It’s free!

There could have been a crash in both situations but if they go through with what they promised the “worse” won’t begin to describe it.

Investors are, however, betting that Trump’s plan to cut taxes and raise tariffs will push up inflation and reduce the pace of interest rate cuts.

Higher rates for longer mean investors will get better returns on savings and investments they hold in dollars.

So they are hoping we’ll get more inflation so they can get better returns on their bonds, and trump will spin this as good for the economy . Fuck finance, fuck Trump and fuck this shit country.

Not my salary lol

Bitcoin OK. Dollar?

My take is that it is reaction that American society will be stable going forward, no election riots etc. Just business as usual.

Yup should be fine without a few of these pesky news agencies around anymore or a few of his political rivals or you know, NOAA and a department of education. I’m sure it will be fine and 50,000 government employees won’t be replaced by loyalists. Corporations aren’t really paying taxes now anyway, why would a little less matter. Removing protections for minorities won’t make a difference either or getting out of NATO. And what a relief not to have to vote anymore. Cozying up to every dictator in the world and paying 10% more for everything will be just like any other election.

I think we’re good. Easy Street baby!

Same thing as last time, protests over issues and police having a field day shooting protesters with non lethal ammo (for now) also right wingers open carrying rifles again hoping to get the chance to shoot someone. Big possibility of more people getting arrested for relatively iniccucous behavior like teaching certain subjects, books, pornography and sodomy will probably be banned. Lots of culture war shit to mask the deregulation. Eventually it will impact everyone in a way but that didn’t stop the Vietnam war either.

Business likes Trump and the Republicans because even with the tariffs and trade war nonsense, they still let companies have an extremely long leash.

Now that Chevron is gone, companies are going to have basically free reign.

Not sure the value of a fiat currency will be valuable during a civil war

Markets don’t think that’ll happen, I guess.

Not worth it, and won’t last.

Sugar high

So should I short these, and how do I do that?

So, foreigners like me with US shares can now benefit from the fact that the US population voted for self-exploitation… Thanks, I guess… Would have prefered Kamala anyway…

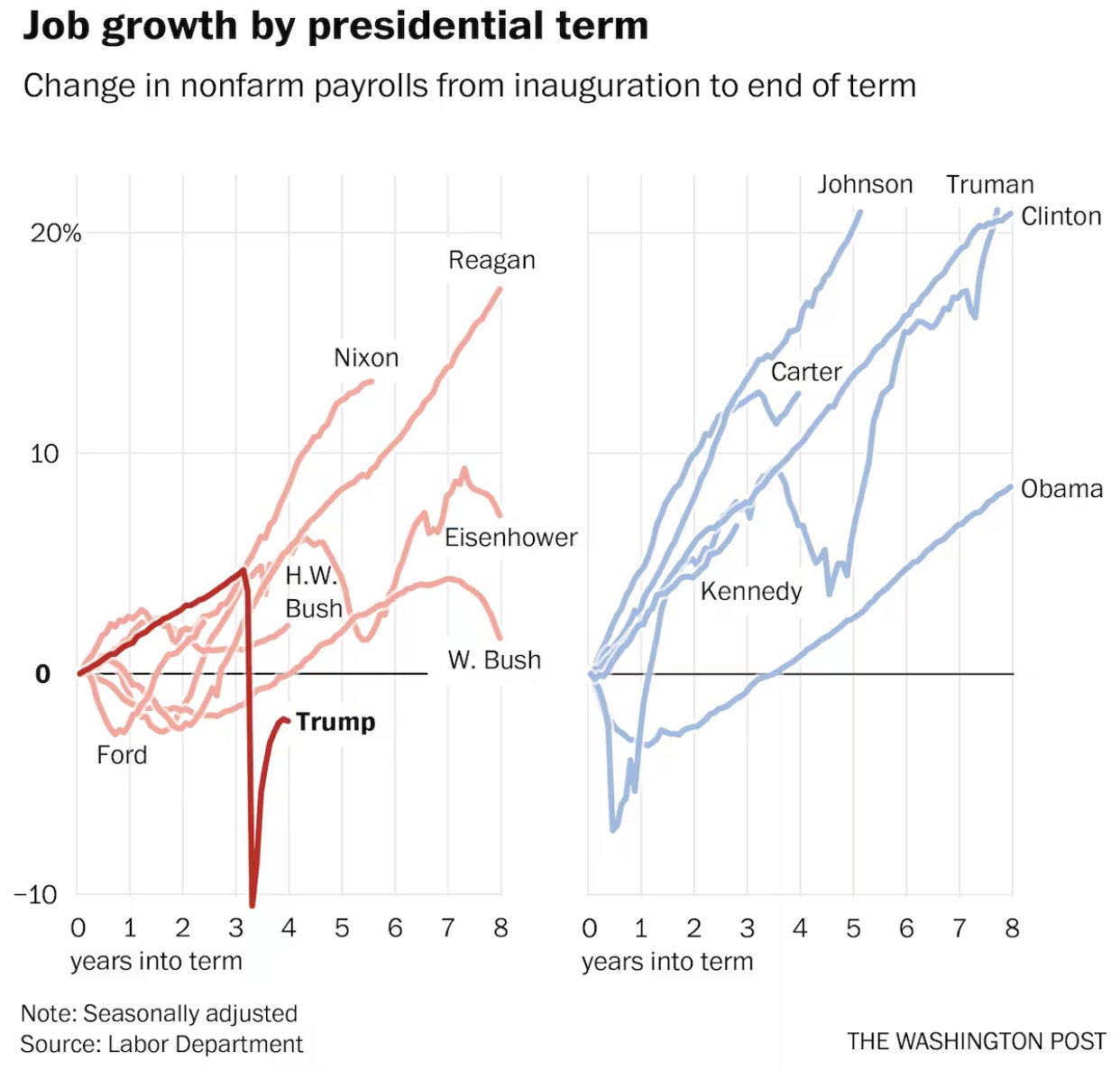

Because republican presidents are famously good at improving the economy; https://www.washingtonpost.com/business/2021/01/08/trump-jobs-record/